APRIL 10, 2024: Why You Should Invest in U.S. Small Cap Equities By Jason Crawshaw, EVP & Portfolio Manager at Polaris Capital Imagine yourself in a casino. Bright, flashing lights, people gathered around tables cheering on their fellow gamblers. The excitement in the room is…

INVESTMENT PERSPECTIVES

Thought leadership guides our business; differing global and international investment perspectives allow for meaningful discussions that coincide with our fundamental research.

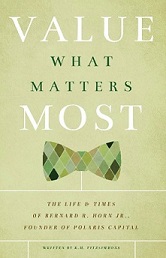

This isn’t the story of another Boston Brahmin money manager who was born with a silver spoon in his mouth. It is a story about a hardscrabble Irish/Italian who came from humble beginnings and was the first generation to go to college. Never mind reaching the elite status of MIT’s Sloan School of Management. But Bernie Horn was never a man to rest on his laurels. Instead, he bucked convention, launching his first entrepreneurial effort right out of Sloan. High aspirations were met with heartache, long hours, and low pay. A brief stint in Corporate America followed; he chafed against the confines and the three-piece suits. Nearly fifteen years after first striking out in investment management, Bernie launched Polaris Capital. From there, it was a zigzag line to success. Nothing was simple, but nothing was insurmountable. Value What Matters Most is a testament to the resilience required to turn a one-man shop into a multimillion-dollar enterprise, without forgetting what is most important in life. To secure your copy today and learn more about Bernie Horn’s global and international investment perspectives, please contact CLIENT SERVICE.

Global & International Investment Perspectives

FEBRUARY 20, 2024: Time Might Be Up For Growth Stocks By Jason Crawshaw, EVP & Portfolio Manager at Polaris Capital 2023 will be remembered as a year of several plot lines. The year started with economists calling for a recession; by summer, the consensus shifted…

JANUARY 08, 2024: Skip The Craze In Favor Of Value Plays In AI By Ken Kim, Senior Investment Analyst at Polaris Capital Primitive versions of artificial intelligence (AI) have been around since the 1960s, but in recent decades advances in machine-learning algorithms, better access to…

DECEMBER 11, 2023: Lessons From The Holiday Classic, “It’s A Wonderful Life” By Sam Horn, Senior Investment Analyst The 2023 banking crisis was set off by just a few banks; leading the charge was Silicon Valley Bank and Signature Financial. The collapse of these two…

NOVEMBER 27, 2023: Is it time to invest in Japan? Changes are afoot. By Ken Kim, Senior Investment Analyst at Polaris Capital 2023 has been a historic year for Japan’s Nikkei 225 and TOPIX 500 indices, reaching their highest levels in more than 33 years….

APRIL 6, 2023: Credit Suisse’s Bailout by UBS – What Impact on European Financials? By Bernard R. Horn Jr., President and Portfolio Manager at Polaris Capital On March 19th, UBS announced it would buy the flagging global investment bank and European financials services firm, Credit…

APRIL 4, 2023: Collapse of SVB: U.S. financials healthy despite crypto collapses By Bernard R. Horn Jr., President and Portfolio Manager of Polaris Capital Much has been written and discussed about the failure of Silicon Valley Bank (SVB) in the last few weeks. While Polaris…

SEPTEMBER 30, 2021: Advance Calculator May Jumpstart Retirement Planning By Bernard R. Horn, Jr., President and Portfolio Manager of Polaris Capital When first starting out in the investment management business in 1980, I launched an investment counseling firm, Horn & Company, to provide global portfolio…

SEPTEMBER 21, 2021: Is value investing ready for a comeback? By Sam Horn, Senior Investment Analyst Since the inception of the stock market, investors have witnessed a continual tug of war between value investing and growth investing styles. History repeats itself, with 10-year (plus or…

APRIL 23, 2021: ESG testing must go beyond the basics By Bernard R. Horn, Jr., President and Portfolio Manager of Polaris Capital As the global ESG “industry” grows, evidenced by a staggering $40.5 trillion in dedicated global assets (as of 2020), there is a rush…