NOVEMBER 27, 2023: Is it time to invest in Japan? Changes are afoot.

By Ken Kim, Senior Investment Analyst at Polaris Capital

Yet for every optimistic investor flooding into Japan is an equally skeptical one, pointing to the era of “Abenomics”. Prime minister Shinzo Abe stood in front of the cameras in 2014, touting his ability to shake up the staid operations of Japanese companies. It was a tall order after years of economic malaise (following the 1980s bubble burst), as companies chaffed against employee raises or shareholder dividends. It wasn’t the sea change Abe predicted, with an economy that has barely grown in the past decade. But times are changing… and two reasons are at the core: 1) inflation and 2) corporate governance revamp.

While inflation has challenged many developed economies, it’s a welcome sign in Japan, which has been battling chronic deflation since the 1990s. Lackluster earnings growth was the expectation and the norm for corporate Japan relative to developed market peers for nearly 30 years, coming in at just 1.3% per year. They are finally making up for the lost decades, as inflation data comes in.

A notable shift in inflation expectations and price-setting behavior has taken hold in Japan. Inflation has been above the Bank of Japan’s (BoJ) 2% target since April 2022, the most enduring bout of inflation since the 1990s. In 2023, the BoJ reiterated its dovish monetary policy stance, announcing an end on yield curve control. This may portend the first steps to the end of the BoJ’s extreme monetary policy stance.

Higher inflation has been largely driven by short-term supply shortages, instead of wage growth. Now, the challenge is to sustain and broaden the increase in incomes. A survey by a business group found that large companies agreed to raise salaries an average of 3.9% this year, the highest rate in decades. The owner of Uniqlo has promised its workers raises of up to 40%. The government is focused on raising wages and making it easier for workers to switch jobs in pursuit of higher pay, per Prime Minister Fumio Kishida. The circular argument for real wage inflation is simple: higher wages equal more purchasing power; consumers ability to absorb higher-priced goods and services might just be the tailwind needed to impact corporate revenue and earnings growth.

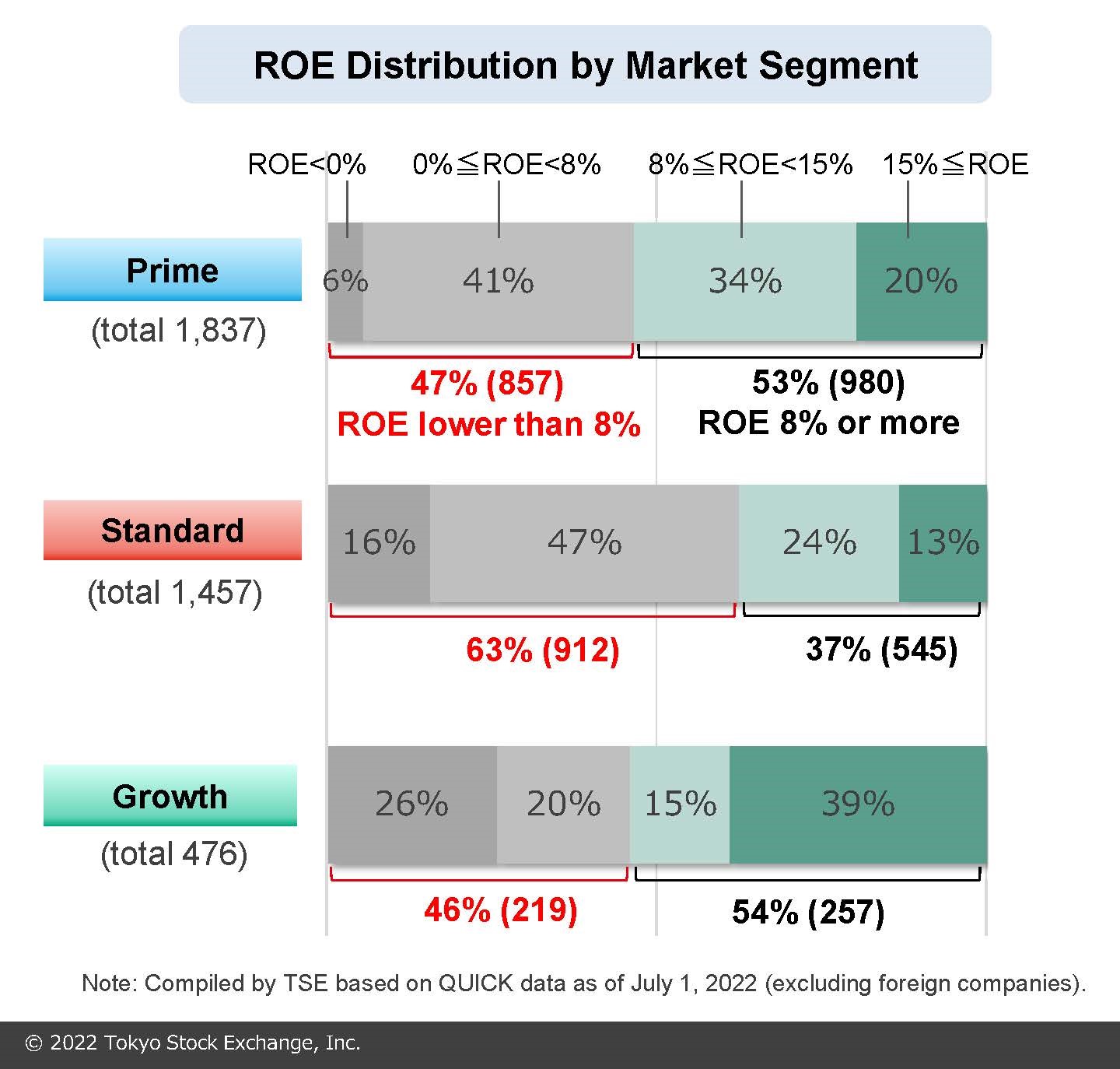

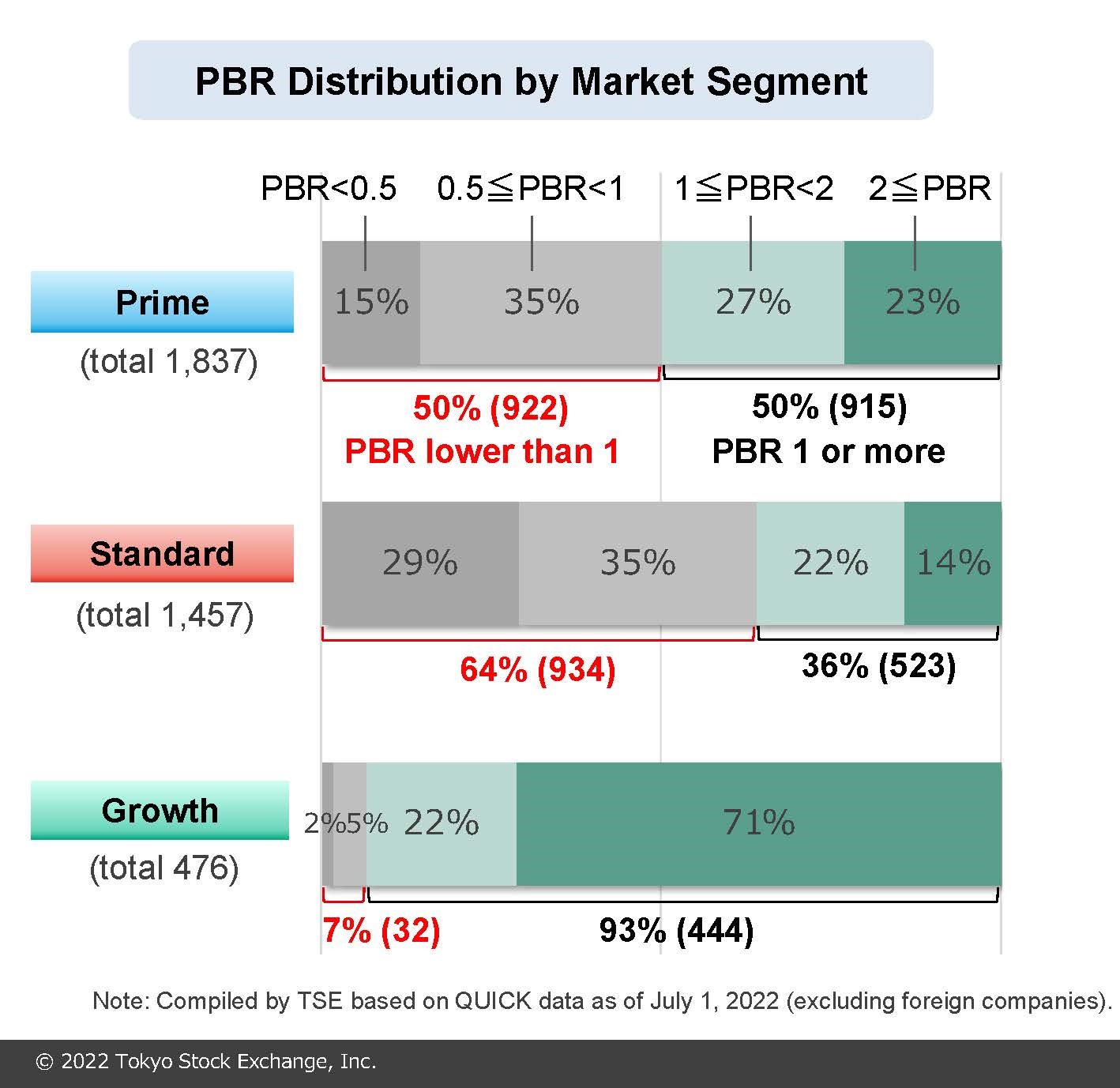

Historically, Japan has traded at a low multiple because of corporate governance issues, as many companies have resisted change. The abysmally low return on equity (ROE – a gauge of profitability) is a good example; the ROE for the MSCI Japan Index stood at 9.9% at end of 2022, compared to 14.7% for the MSCI World Index. The Tokyo Stock Exchange (TSE) noted that half the number of its “prime” listings — the most liquid stocks with the largest market capitalization — and about 65% of those in the “standard” listings have an ROE of <8% or are trading at price-to-book value of less than one. About 43% of companies in the TOPIX 500 trade at book value of less than one compared to only 5% in the S&P 500 and 24% in the European STOXX 600. Corporate profitability or shareholder dividends took a back seat to cash-heavy balance sheets, cross shareholdings, capital expenditures with questionable profitability, and a lack of financial transparency across many insular companies and conglomerates.

On April 22, 2022, the Tokyo Stock Exchange (TSE) announced a major revision of its market into 3 segments: Prime, Standard, and Growth. In March 2023, the TSE published extensive corporate governance guidelines and subsequently announced the new JPX Prime 150 Index, which selects stocks with a focus on value creation. Value creation is based on two criteria: 1. the equity spread defined as the Return on Equity less the cost of shareholders’ equity and 2. Price to Book Value (PBR). Importantly, the cost of equity is to be determined using the Capital Asset Pricing Model. The top 500 stocks by market capitalization are eligible for inclusion in the JPX Prime 150 Index; of those eligible, only the top 75 companies based on the equity spread and the top 75 companies ranked by PBR are included. The Prime 150 will be rebalanced each August, among the Prime 500, so companies that do not remain highly ranked will be delisted out of the Prime 150.

How will companies improve their value creation criteria? Some of the easiest ways to do so is to improve or divest underperforming business units, sell cross shareholdings, improve returns on capital expenditures, pay larger dividends and buy back stock. We expect companies will experience “peer pressure” to follow suit or otherwise lose face in front of the public. In recent months, Citizen Watch has said it would buy back up to a quarter of its shares (visit the Citizen website to view the release: https://www.citizen.co.jp). Among past and present Polaris holdings (current as of 11/13/23), KDDI Corp. announced share repurchases of $1.9 billion during the period from June 1, 2023 to May 31, 2024 (~3% of market capital). Honda Motor Co., Ltd. (recently sold by Polaris) announced a $1.9 billion (~2.5% of market capital) share buyback for the fiscal year ending March 2024.

All in all, Japanese corporations announced a record $70 billion in buybacks in the year that ended in March, according to the Nikkei newspaper. Dividends for the current year are likely to hit another record, topping $100 billion. According to QUICK FactSet, the total return ratio for Japan now is hovering around 50%. That means that almost half of all profits earned are being distributed to shareholders.

Companies included in the TSE Prime 150 include several Polaris holdings as of (11/13/23) including Sony Group Corp., KDDI Corp., Itochu Corp., Marubeni Corp., Daito Trust Construct Co., and Open House Group Co. (Listing based on JPX Prime 150 Index Constituents List with Weights as of May 26, 2023) For more information about some of Polaris’ current holdings, REVIEW OUR QUARTERLY COMMENTARIES

History of conglomerates (with circular shareholding structure, non-core businesses, lots of subsidiaries – Mitsubishi/Sumitomo) made company analysis, valuation and free cash flow prediction very complex. International investors simply shied away from companies without financial transparency. Yet, over time, the circular ownership structure decreased, as Japanese companies divest non-core assets.

Sony Electronics (a current Polaris holding as of 11/13/23) would be a good restructuring example, as the company started to unwind its hardware legacy business (Sony’s historic product line-up of TVs, VCRs, Walkmans and landline/mobile phones) in 2014; assets were written down or sold off, while overseas phone manufacturing plants were shuttered. They shied away from hardware/physical discs to become more “asset light”, and built a more platform-based company including online gaming (focused on a subscriber model with in-game monetization), PlayStations, music and image sensor businesses.

Another example: Hitachi could be one of the top five largest Japanese company over the next 10 years or so. Hitachi has owned many, many different divisions: elevators, energy, nuclear, IT services, chemicals, semiconductor, construction business, automobiles, metals/aluminum business, etc. Over time, the company has reshuffled the portfolio to exit some of the low-profit, heavy cap-ex or cyclical businesses. The firm is now more transparent to investors. Hitachi focused on digital transformation (DX); shifting gears and investing in recurring revenues and more IT. Other Japanese companies have followed suit and have gotten a lot less complicated as a business.

As a value manager, Polaris looks for undervalued but fundamentally strong companies that are cornerstones within their respective industries. Japan has a wealth of technology and frontrunner firms that are among the best in the business; yet, the feeding frenzy in Japan has caused many stock multiples to re-rate. In other words, it might look expensive to invest in Japan right now unless you know where to look.

We watched Japanese trading houses for several years, subsequently investing in Marubeni and Itochu. In June 2023, Warren Buffet announced he will boost his ownership in trading companies up to 9.9%. The valuation of trading companies is much lower than the Japan market in general. Broadly diversified trading companies are exposed to 35% or more of the domestic economy, with the balance around the world and often tied to trade with the Japanese economy.

Digital transformation (DX) is another interesting space, as Japan has been comparatively slow to digitize its products/services/offerings or technology migration at the corporate level; we believe that IT consulting, implementation and hardware/software focused on this space has potential.

Another investment angle might include the spin-offs or remaining corporate entities following restructuring efforts, similar to what we have seen with Hitachi and Sony. In 2020 alone, Hitachi Capital was bought by Mitsubishi UFJ Lease, while Hitachi Metals and Hitachi Construction Machinery were projected to be spun-off. Finding good restructuring stories may be an opportunity for value investors to make money in Japan over time.

The winds of change are moving in Japan, on the back of TSE market structure changes coupled with higher inflation driving rising real wage expectation; Japanese companies are reacting in the right way. As corporate governance improves and shareholders reap rewards, Japanese equity markets prove a lot more appealing. We know of few countries in the world at this time who are pressuring companies to reward shareholders with improved value creation. At this point, foreign investors have taken notice resulting in good Japanese equity returns.

We are hopeful that Japan sees some lingering inflation, spurring on the BoJ to raise short-term rates from -0.1% to zero or even 0.1%. However, without a sure sign of real wage increases and stronger domestic consumption that lend to a strengthened Japanese economy, the BoJ will be hard pressed to tighten rates. This may be the final piece of the puzzle to really sustain Japanese equity markets.

This blog was penned by Kenneth D. Kim, Senior Investment Analyst, in November 2023. Mr. Kim joined the firm in June 2016 as an Analyst; he was promoted to Senior Investment Analyst in January 2021, and became an LLC member in January 2022. Mr. Kim collaborates with an experienced team of portfolio managers and analysts, all of who are considered generalists and perform fundamental analysis of potential investment opportunities.

IMPORTANT INFORMATION: The views in this article were those of Kenneth D. Kim as of the article’s publication date (November 27, 2023) and may be subject to change. Information, particularly facts and figures, are dated and in many cases outdated. Views and opinions of Kenneth D. Kim expressed herein do not necessarily state or reflect those of Polaris Capital Management, and are not nor shall be used for advertising or product endorsement purposes. Polaris Capital is an investment adviser registered with the Securities and Exchange Commission. For more information about Polaris, please contact us at (617) 951-1365 or at clientservice@polariscapital.com.

Karl A. Ruggeberg

Feb 21, 2024 -

A succint but very insightful analysis of the key drivers for the long-awaited resuscitation of the Japanese stock market since its collapse in 1989.

In light of the recent measures taken by the government and the TSE, an overweighted position of highly selected Japanese equities in the Global Fund seems warranted. I personally would be more cautious with the Korean market, not to mention the Chinese market.

Congratulations again on such an excellent report!