DECEMBER 11, 2023: Lessons From The Holiday Classic, “It’s A Wonderful Life”

By Sam Horn, Senior Investment Analyst

After the Great Financial Crisis of 2007-2008, regulators required more capital and buffers to ensure banks’ resilience in the face of credit events. As a result, the banking system is largely very safe with the amount of capital controls and stress tests. Hammering home the regulatory framework, on December 6, 2023, the CEOs of top U.S. banks testified before Congress on potential new capital requirements. And Basel III will phase in starting July 2025, at which time the largest U.S. banking institutions will need to adjust their capital further in order to be in compliance at the three-year mark. This will change the way the banks think about regulatory capital and extend more granular, rigorous requirements to the U.S. banks.

But before that …Silicon Valley Bank… SVB was the poster child for a shaky business model, banking for the venture capital (VC) industry, including its early-stage startups. During the period of ultra-low interest rates, VCs raised large sums of capital, which resulted in large cash deposits on SVB’s books from its VC clients and their portfolio companies. Importantly, 95% of these large deposits were uninsured. In an effort to make more money, SVB management decided to invest these short-term cash deposits in longer-term securities for higher yields. Longer maturity bond prices can drop rapidly if interest rates increase, but SVB management was willing to take that risk.

It was a fateful decision, as interest rates rose when the Federal Reserve engaged in its well-publicized monetary policy. The SVB securities portfolio incurred substantial unrealized losses. By the end of 2022, these unrealized losses wiped out the equity capital of the firm. As this shoddy accounting came to light, SVB’s customers panicked. Fueled by social media, there was a rapid run on the bank.

There is no preventing a run on a bank. As showcased in holiday classic movie, “It’s A Wonderful Life”, town banker George Bailey (James Stewart) pled with bank depositors to not withdraw their funds all at once, which if happened would cause the bank to fail. The tale was told in the fictional town of Bedford Falls in the 1940s. But what isn’t fiction is the fact that even 80 years later, a bank isn’t insulated from a run if the conditions are ripe – hence the SVB collapse. And unlike the Bedford Falls residents, who had to physically visit a bank branch, the SVB deposit flight was online and essentially frictionless, with $42 billion in withdrawals in a day.

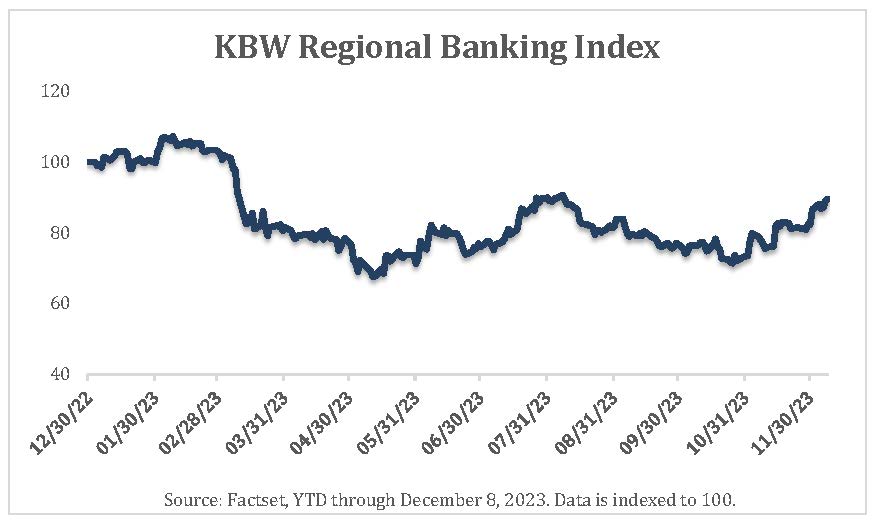

The SVB collapse on March 10, 2023 was followed by the failures of Signature Bank-NY two days later, and then First Republic on May 1. After the Fed rode in to the rescue (and regulators facilitated the acquisition of these failed banks by other institutions), the U.S. bank market calmed down but not until most bank stocks plummeted 30-50%. Not all banks deserved to be punished for the clearly poor management decisions of a few banks, but the markets reacted nonetheless. Irrational investor behavior was at the core, facilitating the makings of a polycrisis (a simultaneous occurrence of catastrophic events). To weather any future polycrisis, successful banks must be both well capitalized and nimble to overcome antagonistic monetary policy or tenuous macro-economic conditions.

As U.S. financials dipped in 2023, value investors like us identified prime buying opportunities. But not every bank is built the same; there is no generic business model industrywide. Instead, diligent fundamental research is required, with stringent metrics at the core. For Polaris to consider an investment, the bank optimally must have:

- Strong regulatory capital ratio with ample liquidity sources

- Sticky deposits, with no single commercial sector posing a significant concentration risk. A diverse deposit base across multiple lines of business, customer segments and geographies is preferred.

- A track record of strong organic growth focused on market development in underpenetrated verticals.

- Conservative balance sheet, with flexibility to adjust in a changing interest rate environment. A lower loan-to-deposit ratio is key for flexibility.

- Diversified loan mix with a key tenant of relationship banking and a strong commercial and industrial book of business.

- Time-tested credit metrics with unwavering credit standards. A long tenure through the cycle is desirable.

- Differentiated fee-income generation with a low reliance on mortgage and overdraft revenue.

- Limited commercial real estate exposure: look at duration, repricing, property occupancy rates and tenant types.

- Thoughtful/strategic capital allocation policy: Reinvesting in the business through loan growth, dividend growth and buybacks.

- Management/insiders buying shares in the open market.

We look at the whole spectrum of U.S. bank stocks, from the mutual conversion thrifts to the regionals to the super regional and the major nationals. Inevitably, bankers want to grow via merger or acquisition; our preference is organic growth via opening de novo branches or digital deposits. Yet, both can prove equally successful. Over the past five years, we witnessed a “mergers of equals” phase, as banks sought to create a step change in their respective geographic/product/service footprint. During the market turmoil of 2020, banks hunkered down to focus on their customer base, and inevitably, M&A activity slowed. However, bank deals are ramping up in late 2023, as there is visibility around the rate environment.

The Federal Reserve will likely start to cut rates in the second half of 2024, at which point banks should maintain the pricing of their loans and start to cut back deposit rates; net interest margin improvement should result. Banks with right-sized mortgage books, income generative business and strong credit portfolios may do well; many of these will seek out both organic and acquisitive growth in a more normalized market.

This blog was penned by Samuel Horn, Senior Investment Analyst, in December 2023. Mr. Horn joined the firm in 2012 and re-joined Polaris in August 2016 as an Analyst, after completing his MBA from the MIT Sloan School of Management. He was promoted to Senior Investment Analyst in January 2021, and became an LLC member in January 2022. He continues to work with an experienced research team, all of whom are considered generalists, and perform fundamental analysis of potential investment opportunities.

IMPORTANT INFORMATION: The views in this article were those of Samuel Horn as of the article’s publication date (Dec. 11, 2023) and may be subject to change. Information, particularly facts and figures, are dated and in many cases outdated. Views and opinions of Samuel Horn expressed herein do not necessarily state or reflect those of Polaris Capital Management, and are not nor shall be used for advertising or product endorsement purposes. Polaris Capital is an investment adviser registered with the Securities and Exchange Commission. For more information about Polaris, please contact us at (617) 951-1365 or at clientservice@polariscapital.com.