Small cap stocks have been a profitable asset class over time, as they benefit from what academics refer to as the “small cap premium”. It is the idea that small caps are less efficient, carry a higher level of risk, and are more prone to failure (than large caps), thus requiring a higher level of return to attract investors. For example, from 2000 through the end of 2023, global small cap equities, as measured by the MSCI World Small Cap Index, returned 8.95% compared with 6.53% for global large cap equities, as measured by the MSCI World Large Cap Index. (source: Factset)

However, in recent years, this small cap premium has seemingly vanished; there has been a significant divergence in performance between the two asset classes with global large cap stocks significantly outperforming. In this blog, we explore why that is the case and why we think this trend is set to normalize.

Following the Global Financial Crisis of 2008, the global economy entered into a period of prolonged low, and in some cases, zero, interest rates. With access to cheap capital, investors piled into stocks across the cap-spectrum in search of excess returns with little perceived risk. During this period, most stock markets, regardless of sector, region, or market cap, performed well and investors experienced outsized gains. This held especially true for large caps, which borrowed on the cheap and forged ahead with both organic and acquisitive growth opportunities. Merger and acquisition (M&A) activity ensued in this environment with the number of M&A deals increasing materially from December 2008 through March of 2022. (source: Institute for Mergers, Acquisitions & Alliances)

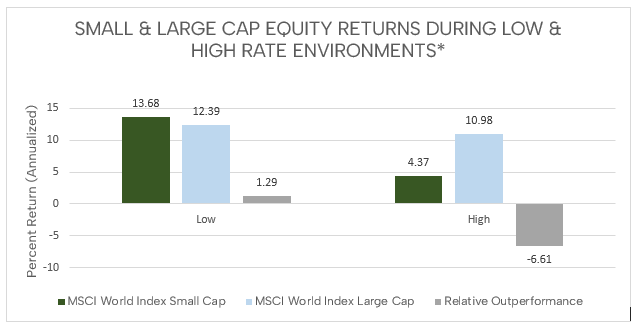

Per the chart below, global small- and large-cap stocks both performed well in the ultra-low rate environment of December 2008 – March 2022. In fact, the MSCI World Small Cap Index returned 13.68%, outperforming the MSCI World Large Cap Index by nearly 130 basis points.

*Low-rate environment defined as period from November 30, 2008 to March 31, 2022. High-rate environment defined as period from March 31, 2022 – August 31, 2024.

Throughout the period of low rates (November 2008-March 2022), consumers spent, companies hired, the global economy chugged along, and inflation began to tick up. In the U.S. alone, the Consumer Price Index rose 1.2% in March 2022, culminating in an 8.5% raise within the year; this marked the highest year-over-year increase in 40 years. Other countries were in a similar predicament, with Europe especially impacted by global energy market costs, rising due to the Russia-Ukraine war and general consumption trends. Even Japan, which averaged 0.8% in the 10 years to 2022, trended higher, with the CPI up 2.5%. In response to these, and other, catalysts, in March of 2022, global central banks began to raise interest rates to combat inflation.

The Federal Reserve raised interest rates 11 times in 2022; the European Central Bank raised fixed rates to 0.5% in July, and then raised the rate in September, November and December of 2022, while continuing through 2023 and mid-2024; the Bank of England raised rates five times in 2022, and subsequently raised rates on a near-monthly basis through August 2023.

On a rising rate backdrop, small-cap stocks started to significantly underperform their large-cap counterparts. In this high-rate environment, which we consider to be March 2022 – August 2024, global small cap stocks underperformed global large cap stocks by over 600 basis points as shown on the chart above.

With rates at elevated levels for an extended period, global economies have shown signs of stagnation. We expect to see rate cuts and a return to more a normalized rate environment. Already, we have seen the Bank of Canada, Bank of England, and European Central Bank lower rates. In June, July and September 2024, the BoC made three back-to-back rate cuts, each at 25 basis points (bps); on August 1st, the BoE made an introductory cut by 25 bps to 5%, the first interest rate drop in four years; and in early September, the ECB lowered its deposit rate by 25 bps to 3.50%, following up on a similar cut in June.

Importantly, we are not arguing that small-cap equities require an ultra-low rate environment to generate attractive returns. In fact, we think rates will remain higher for longer, but as the terminal rate has been reached and will trend lower, it should close the performance gap between large and small-cap companies. Just as an ultra-low rate environment benefitted multi-cap companies, and a higher rate environment benefitted larger companies, a more normalized rate environment should lead to a convergence between the two asset classes.

Polaris Capital Management LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Polaris' website provides general information regarding our business along with access to additional investment related information. Material presented is meant for informational purposes only. To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Polaris or any of its investment professionals. For additional information regarding our services, or to receive a hard copy of our firm's disclosure documents (Form ADV Part I and Form ADV Part II), contact client service. You may also obtain these disclosure documents online from the SEC Investment Adviser Public Disclosure (Firm CRD# 106278). ©2013-2025 Polaris Capital Management, LLC. All rights reserved.

This website uses necessary cookies to make our site work. A handful of non-essential cookies seek to enhance the browsing experience, analyze website traffic and improve site usage and functionality via analytics. By clicking “Accept“, you consent to accept these non-essential cookies; however, you can opt-out by clicking "Deny". See our cookie policy here.

IMPORTANT INFO: RETIREMENT CALCULATOR

The retirement calculator is a model or tool intended for informational and educational purposes only, and does not constitute professional, financial or investment advice. This model may be helpful in formulating your future plans, but does not constitute a complete financial plan. We strongly recommend that you seek the advice of a financial services professional who has a fiduciary relationship with you before making any type of investment or significant financial decision. We, at Polaris Capital, do not serve in this role for you. We also encourage you to review your investment strategy periodically as your financial circumstances change.

This model is provided as a rough approximation of future financial performance that you may encounter in reaching your retirement goals. The results presented by this model are hypothetical and may not reflect the actual growth of your own investments. Polaris strives to keep its information and tools accurate and up-to-date.

The information presented is based on objective analysis, but may not be the same that you find at a particular financial institution, service provider or specific product’s site. Polaris Capital and its employees are not responsible for the consequences of any decisions or actions taken in reliance upon or as a result of the information provided by this tool. Polaris is not responsible for any human or mechanical errors or omissions. All content, calculations, estimates, and forecasts are presented without express or implied warranties, including, but not limited to, any implied warranties of merchantability and fitness for a particular purpose or otherwise.

Please confirm your agreement/understanding of this disclaimer.

DISCLAIMER: You are about to leave the Polaris Capital Management, LLC website and will be taken to the PCM Global Funds ICAV website. By accepting, you are consenting to being directed to the PCM Global Funds ICAV website for non-U.S. investors only.