A: Yes, we are at an inflection point in this historic growth-value dispersion. Many companies that have survived the COVID-19 recession are now entering the early stages of a new bull market, with inflation rising. The Fed calls for “transitory inflation”, which means that the consumer price index (CPI) will increase, but will not leave a permanent mark on inflation. Whether this proves true or not, it has become evident that inflation is here to stay, with the CPI rising 5.4% in July 2021 from a year earlier. The Fed can’t keep printing money forever or keep interest rates artificially low with this much inflation in the economy. Ultimately, the Fed will have to raise interest rates. As stated earlier, mathematically, the discount rate will then go up, and growth stocks will decline because the current value of the future cash flows will be worth much less. That is why we saw a steep sell-off in March 2021 and again in June 2021, when the Fed hinted at possible rate hikes in 2022.

Inherently, value stocks will start to run on higher inflation and renewed pricing power, along with new infrastructure spending and early stages of economic expansion. Cyclical value sectors, like materials and financials, are primed for success. In the case of financials, the steepening of the yield curve boosts banks’ net interest margins, as banks generally borrow short-term and lend long-term. We expect banks to start returning capital to shareholders (buybacks and dividends), no longer wary about mortgage defaults and bankruptcies. As commodity prices rise, companies selling these materials are in a perfect position. For example, copper prices climbed markedly for the first time in more than a decade as investors bet that the economic rebound will drive demand for industrial metals; iron ore prices have also hit records. We also see tangential beneficiaries of higher prices; in talking to our portfolio companies on a weekly basis, many are echoing the same sentiment. Yes, we’re seeing higher raw material prices (lumber, steel, iron ore) but are baking those costs into higher pass-through prices. Since these cycles typically are multi-year and we are at the initial stages of the expansion, now is the time to take advantage of this trend in materials, industrials and consumer discretionary, where our portfolios have overweight positions.

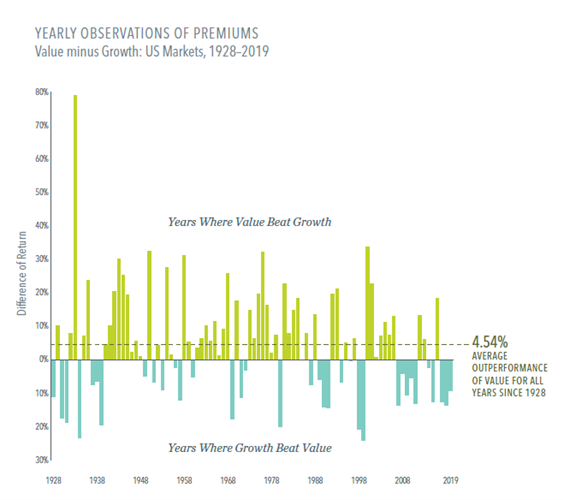

A: This rotation should have legs — particularly in light of better relative valuations for value stocks, prospects for economic growth, and the likelihood of inflation (which disproportionately hurts growth and tech stocks). However, the tug of war evident in the second quarter of 2021 is likely to continue and the progress of value stocks might take place in fits and starts.

Another important point: once COVID-19 abates and inflation continues to rise, analysts will revise down estimates and growth stocks will take it on the chin. The benchmark is so concentrated around these FAANG growth names that once expectations aren’t meant and they start printing bad numbers, inadvertently, the index itself will come down. Those stocks not aligned with the benchmark will likely do much better; many of those are smaller cap value names. And truth be told, many values names are now producing cash favorably and are in better shape on a fundamental basis. Most companies negatively impacted by COVID-19 proactively implemented cost-cutting measures and shored up their balance sheets. The same cannot be said for most growth companies, after depleting money on advertising and market budgets and aggressively hiring in hopes of attracting customers; bottom line cash flow proved an afterthought. Ultimately, investors will realize the promise of lofty assumptions and estimates are just that; the market will come back to the undervalued companies that we hold so dear.

Polaris Capital Management LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Polaris' website provides general information regarding our business along with access to additional investment related information. Material presented is meant for informational purposes only. To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Polaris or any of its investment professionals. For additional information regarding our services, or to receive a hard copy of our firm's disclosure documents (Form ADV Part I and Form ADV Part II), contact client service. You may also obtain these disclosure documents online from the SEC Investment Adviser Public Disclosure (Firm CRD# 106278). ©2013-2025 Polaris Capital Management, LLC. All rights reserved.

This website uses necessary cookies to make our site work. A handful of non-essential cookies seek to enhance the browsing experience, analyze website traffic and improve site usage and functionality via analytics. By clicking “Accept“, you consent to accept these non-essential cookies; however, you can opt-out by clicking "Deny". See our cookie policy here.

IMPORTANT INFO: RETIREMENT CALCULATOR

The retirement calculator is a model or tool intended for informational and educational purposes only, and does not constitute professional, financial or investment advice. This model may be helpful in formulating your future plans, but does not constitute a complete financial plan. We strongly recommend that you seek the advice of a financial services professional who has a fiduciary relationship with you before making any type of investment or significant financial decision. We, at Polaris Capital, do not serve in this role for you. We also encourage you to review your investment strategy periodically as your financial circumstances change.

This model is provided as a rough approximation of future financial performance that you may encounter in reaching your retirement goals. The results presented by this model are hypothetical and may not reflect the actual growth of your own investments. Polaris strives to keep its information and tools accurate and up-to-date.

The information presented is based on objective analysis, but may not be the same that you find at a particular financial institution, service provider or specific product’s site. Polaris Capital and its employees are not responsible for the consequences of any decisions or actions taken in reliance upon or as a result of the information provided by this tool. Polaris is not responsible for any human or mechanical errors or omissions. All content, calculations, estimates, and forecasts are presented without express or implied warranties, including, but not limited to, any implied warranties of merchantability and fitness for a particular purpose or otherwise.

Please confirm your agreement/understanding of this disclaimer.

DISCLAIMER: You are about to leave the Polaris Capital Management, LLC website and will be taken to the PCM Global Funds ICAV website. By accepting, you are consenting to being directed to the PCM Global Funds ICAV website for non-U.S. investors only.