The Polaris investment philosophy holds true for the international small cap portfolio, as we seek to identify the most undervalued stocks with strong fundamentals at a given period, with diversification across industry and sector. Many of these smaller international companies are thinly covered by analysts. This is where the opportunity lies: we are able to dig in and find undervalued stocks within the international small cap space. Our only confine is market cap… and this is far from a limitation, as there is an ever increasing number of small cap companies entering global stock markets.

When investing in a new security for an international small cap portfolio, we seek to purchase companies with a market cap greater than $50 million and less than $5 billion. After the initial purchase of a security, its market capitalization may fall below $50 million or appreciate to greater than $2 billion. There is no formal guideline for minimum or maximum market cap of any one security in the portfolio.

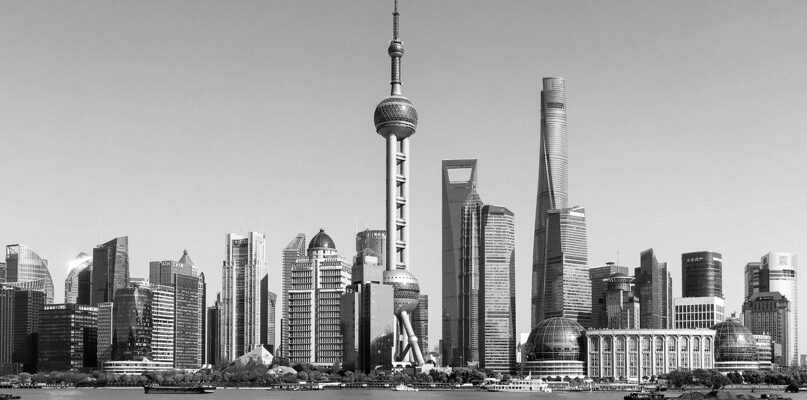

The 60 to 80 stock portfolio is composed of non-U.S. companies located in Europe, Australia and the Far East (otherwise considered the countries comprising the MSCI ACWI ex USA Small Cap Index). We are mindful of emerging market exposure, looking to limit investment in these markets to no more than 35% of the small cap portfolio. The investment process generally leads the portfolio to be well diversified – with investments in 15 or more foreign markets and 15 or more industries. The country and industry diversification helps reduce the likelihood that negative performance of a single country or industry will significantly impact the portfolio’s return.

The industry/sector/country exposure changes gradually over time as a function of which small cap stocks are the most undervalued in the world at a given period. Our bottom-up research seeks to identify individual stocks with strong, undervalued cash flows, regardless of location or industry. Learn more about sustainable free cash flow relative to Polaris’ Global Cost of Equity.The investment process for the portfolio combines both quantitative and fundamental techniques to find these undervalued streams of cash flow.

The Fund uses proprietary computer models to rank countries and industries on the basis of value and to narrow a universe of over 30,000 companies down to 400 to 600 deserving of further consideration. The Fund supplements the screening process by performing in-depth financial and fundamental analysis.

Visit the Pear Tree Funds website to obtain the latest reporting and fact sheets on the Pear Tree Polaris Foreign Value Small Cap Fund.

Polaris Capital Management LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Polaris' website provides general information regarding our business along with access to additional investment related information. Material presented is meant for informational purposes only. To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Polaris or any of its investment professionals. For additional information regarding our services, or to receive a hard copy of our firm's disclosure documents (Form ADV Part I and Form ADV Part II), contact client service. You may also obtain these disclosure documents online from the SEC Investment Adviser Public Disclosure (Firm CRD# 106278). ©2013-2025 Polaris Capital Management, LLC. All rights reserved.

This website uses necessary cookies to make our site work. A handful of non-essential cookies seek to enhance the browsing experience, analyze website traffic and improve site usage and functionality via analytics. By clicking “Accept“, you consent to accept these non-essential cookies; however, you can opt-out by clicking "Deny". See our cookie policy here.

IMPORTANT INFO: RETIREMENT CALCULATOR

The retirement calculator is a model or tool intended for informational and educational purposes only, and does not constitute professional, financial or investment advice. This model may be helpful in formulating your future plans, but does not constitute a complete financial plan. We strongly recommend that you seek the advice of a financial services professional who has a fiduciary relationship with you before making any type of investment or significant financial decision. We, at Polaris Capital, do not serve in this role for you. We also encourage you to review your investment strategy periodically as your financial circumstances change.

This model is provided as a rough approximation of future financial performance that you may encounter in reaching your retirement goals. The results presented by this model are hypothetical and may not reflect the actual growth of your own investments. Polaris strives to keep its information and tools accurate and up-to-date.

The information presented is based on objective analysis, but may not be the same that you find at a particular financial institution, service provider or specific product’s site. Polaris Capital and its employees are not responsible for the consequences of any decisions or actions taken in reliance upon or as a result of the information provided by this tool. Polaris is not responsible for any human or mechanical errors or omissions. All content, calculations, estimates, and forecasts are presented without express or implied warranties, including, but not limited to, any implied warranties of merchantability and fitness for a particular purpose or otherwise.

Please confirm your agreement/understanding of this disclaimer.

DISCLAIMER: You are about to leave the Polaris Capital Management, LLC website and will be taken to the PCM Global Funds ICAV website. By accepting, you are consenting to being directed to the PCM Global Funds ICAV website for non-U.S. investors only.