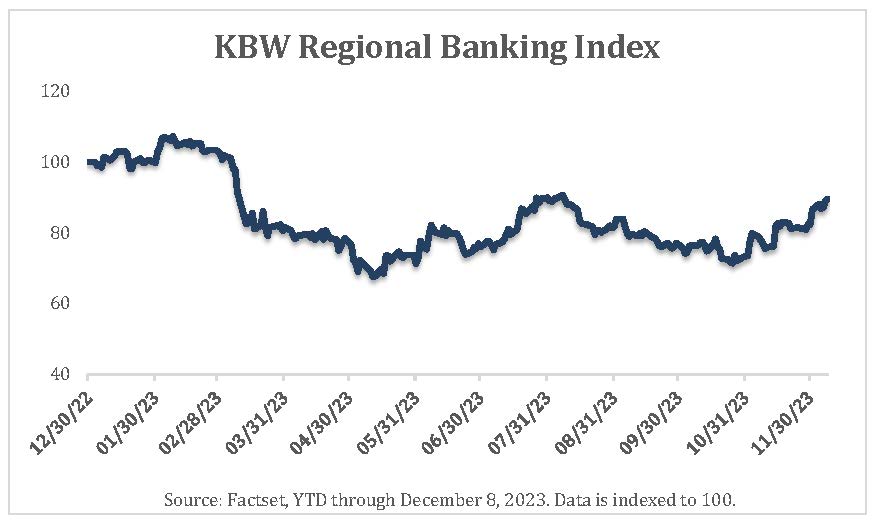

The 2023 banking crisis was set off by just a few banks; leading the charge was Silicon Valley Bank and Signature Financial. The collapse of these two tech-laden banks shocked the U.S. banking system and drew scrutiny from Federal regulators. Markets were jittery with the news, and the entire industry was under pressure. But was the worry about U.S. bank stocks warranted?

After the Great Financial Crisis of 2007-2008, regulators required more capital and buffers to ensure banks’ resilience in the face of credit events. As a result, the banking system is largely very safe with the amount of capital controls and stress tests. Hammering home the regulatory framework, on December 6, 2023, the CEOs of top U.S. banks testified before Congress on potential new capital requirements. And Basel III will phase in starting July 2025, at which time the largest U.S. banking institutions will need to adjust their capital further to be in compliance at the three-year mark. This will change the way the banks think about regulatory capital and extend more granular, rigorous requirements to the U.S. banks.

As U.S. financials dipped in 2023, value investors like us identified prime buying opportunities. But not every bank is built the same; there is no generic business model industrywide. Instead, diligent fundamental research is required, with stringent metrics at the core. For Polaris to consider an investment, the bank optimally must have:

We look at the whole spectrum of U.S. bank stocks, from the mutual conversion thrifts to the regionals to the super regional and the major nationals. Inevitably, bankers want to grow via merger or acquisition; our preference is organic growth via opening de novo branches or digital deposits. Yet, both can prove equally successful. Over the past five years, we witnessed a “mergers of equals” phase, as banks sought to create a step change in their respective geographic/product/service footprint. During the market turmoil of 2020, banks hunkered down to focus on their customer base, and inevitably, M&A activity slowed. However, bank deals are ramping up in late 2023, as there is visibility around the rate environment.

Polaris Capital Management LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Polaris' website provides general information regarding our business along with access to additional investment related information. Material presented is meant for informational purposes only. To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Polaris or any of its investment professionals. For additional information regarding our services, or to receive a hard copy of our firm's disclosure documents (Form ADV Part I and Form ADV Part II), contact client service. You may also obtain these disclosure documents online from the SEC Investment Adviser Public Disclosure (Firm CRD# 106278). ©2013-2025 Polaris Capital Management, LLC. All rights reserved.

This website uses necessary cookies to make our site work. A handful of non-essential cookies seek to enhance the browsing experience, analyze website traffic and improve site usage and functionality via analytics. By clicking “Accept“, you consent to accept these non-essential cookies; however, you can opt-out by clicking "Deny". See our cookie policy here.

IMPORTANT INFO: RETIREMENT CALCULATOR

The retirement calculator is a model or tool intended for informational and educational purposes only, and does not constitute professional, financial or investment advice. This model may be helpful in formulating your future plans, but does not constitute a complete financial plan. We strongly recommend that you seek the advice of a financial services professional who has a fiduciary relationship with you before making any type of investment or significant financial decision. We, at Polaris Capital, do not serve in this role for you. We also encourage you to review your investment strategy periodically as your financial circumstances change.

This model is provided as a rough approximation of future financial performance that you may encounter in reaching your retirement goals. The results presented by this model are hypothetical and may not reflect the actual growth of your own investments. Polaris strives to keep its information and tools accurate and up-to-date.

The information presented is based on objective analysis, but may not be the same that you find at a particular financial institution, service provider or specific product’s site. Polaris Capital and its employees are not responsible for the consequences of any decisions or actions taken in reliance upon or as a result of the information provided by this tool. Polaris is not responsible for any human or mechanical errors or omissions. All content, calculations, estimates, and forecasts are presented without express or implied warranties, including, but not limited to, any implied warranties of merchantability and fitness for a particular purpose or otherwise.

Please confirm your agreement/understanding of this disclaimer.

DISCLAIMER: You are about to leave the Polaris Capital Management, LLC website and will be taken to the PCM Global Funds ICAV website. By accepting, you are consenting to being directed to the PCM Global Funds ICAV website for non-U.S. investors only.