A: Our outlook for interest rates in 2025 is nuanced. As evidenced above, U.S. banks have been extremely adaptable and resilient, reworking their balance sheets and management strategies in a lower interest rate environment. But that could turn on a dime…

On December 18th, the Federal Reserve made its third consecutive cut of 2024, lowering rates by a full percentage point since September. But more reductions hinge on combatting stubbornly high inflation, with Fed Chairman Jerome Powell suggesting caution with the incoming Trump administration. While price pressures are expected to ease, the Fed Board is beginning to ponder the incoming administration’s economic policies (promises of higher tariffs, onshoring, tax cuts and immigration policies) that may prove to be somewhat inflationary.

This draws into question the pace and magnitude of 2025 cuts, which may be more modest than previously anticipated. This could spell challenging news for the banks’ mortgage business, which typically benefits from lower rates. At the same time, higher-for-longer rates play into the “maturity transformation” business model, which is the bread and butter of the banking industry. With a steeper yield curve, banks are able to borrow money at low short-term interest rates and lend it out at higher long-term interest rates, resulting in a larger profit margin due to the significant difference between the rates.

A: Overregulation: The regulatory burden has been a significant factor driving industry consolidation, particularly impacting smaller institutions. The regulatory requirements for community banks are especially onerous, as they often need to implement the same systems and processes as mid-sized banks, despite having fewer resources. This disproportionate burden can hinder their ability to compete effectively and serve their local communities.

Inflation Trends: With some speculation that Trump policies might prove inflationary, the Fed may keep rates higher for longer. Add to the mix the strength of job market, which puts upward pressure on wages; companies respond by increasing prices on goods and services (the wage-price spiral), pushing inflation higher. If interest rates don’t trend downward, consumers are stuck with higher auto loans and pricey mortgage payments.

Banks that were expecting a lower rate environment on a faster timeline may have to rearrange their consumer and commercial portfolios. A higher rate environment means possibly lower economic activity and fewer consumer auto loans and mortgage originations. That says nothing for the commercial real estate markets, that might face refinancing or foreclosure. At the same time, if interest rates continue to ease heading into 2025 (on pace with another percentage point drop), these headwinds become less concerning.

Prediction is very difficult, especially if it's about the future!

- Niels Bohr (Nobel laureate in Physics and father of the atomic model)

While expectations might be directionally correct, it is very difficult to predict the true path of the Fed Funds rate. Bank managements need to be flexible, adapting their investment portfolios and lending practices to the variability of rate decisions and timelines.

A: Under Republican regulators, we anticipate shake-ups in the following areas:

A: U.S. Federal bank regulators are especially busy in the waning days of 2024; for example, they just released payment service pricing details and asset thresholds in effect for all of 2025. Come the first of the new year, Federal regulators will be out in force meeting with various banking institutions – all under the Biden administration’s oversight. It will be interesting to see the tone and direction of change, after the new administration officially takes office in late January 2025, and ultimately installs new regulators.

That said, it’s important to note that significant changes in Federal Reserve monetary policy may take longer to materialize, as Jerome Powell’s term as Chair continues until May 2026. This could provide some continuity in overall monetary policy direction, even as regulatory approaches shift.

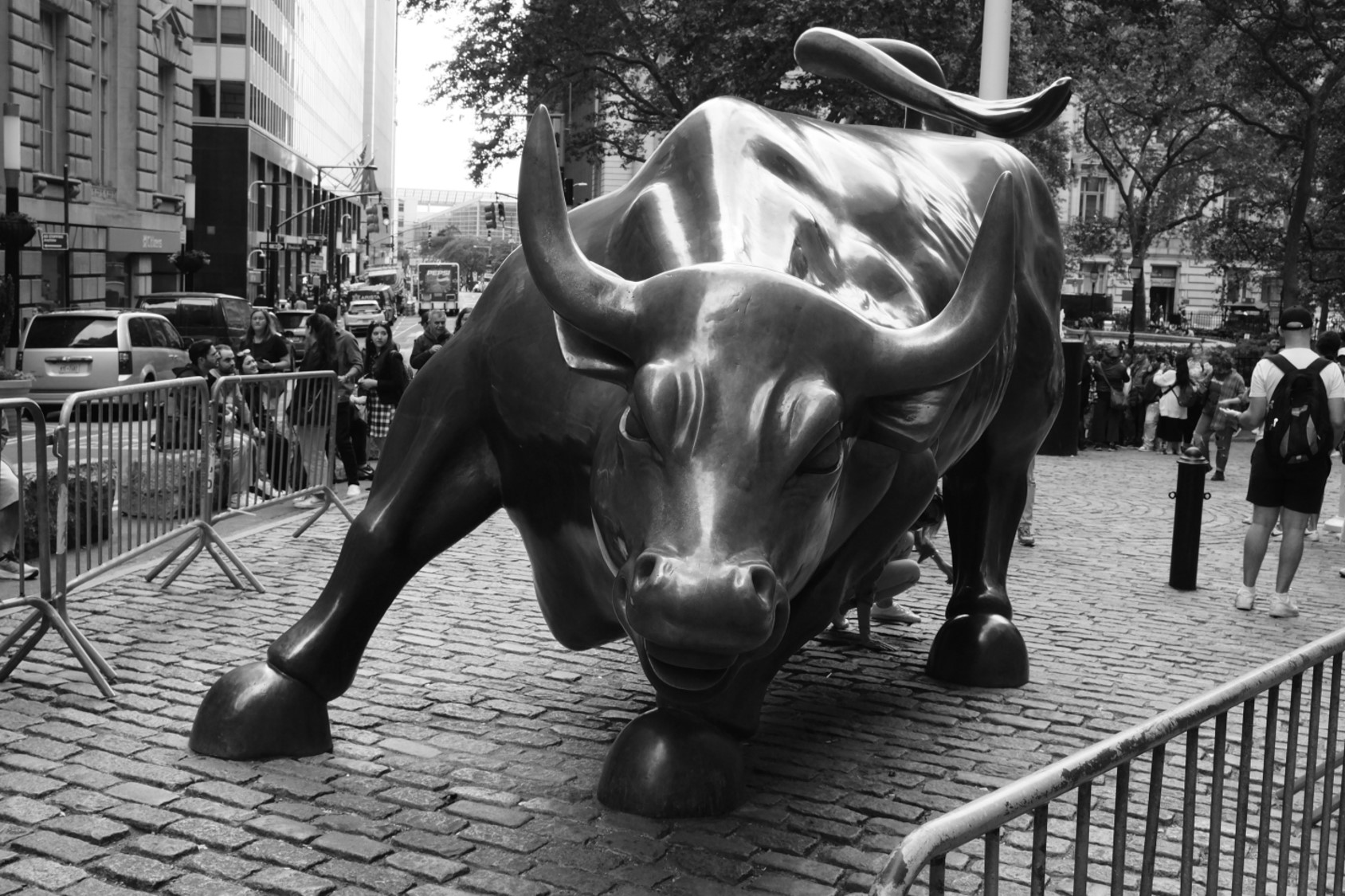

2024: STELLAR PERFORMANCE OF U.S. REGIONAL BANKS

SOURCE: SPDR S&P Regional Banking ETF, data through 12/04/24

Polaris Capital Management LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). Polaris' website provides general information regarding our business along with access to additional investment related information. Material presented is meant for informational purposes only. To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Polaris or any of its investment professionals. For additional information regarding our services, or to receive a hard copy of our firm's disclosure documents (Form ADV Part I and Form ADV Part II), contact client service. You may also obtain these disclosure documents online from the SEC Investment Adviser Public Disclosure (Firm CRD# 106278). ©2013-2025 Polaris Capital Management, LLC. All rights reserved.

This website uses necessary cookies to make our site work. A handful of non-essential cookies seek to enhance the browsing experience, analyze website traffic and improve site usage and functionality via analytics. By clicking “Accept“, you consent to accept these non-essential cookies; however, you can opt-out by clicking "Deny". See our cookie policy here.

IMPORTANT INFO: RETIREMENT CALCULATOR

The retirement calculator is a model or tool intended for informational and educational purposes only, and does not constitute professional, financial or investment advice. This model may be helpful in formulating your future plans, but does not constitute a complete financial plan. We strongly recommend that you seek the advice of a financial services professional who has a fiduciary relationship with you before making any type of investment or significant financial decision. We, at Polaris Capital, do not serve in this role for you. We also encourage you to review your investment strategy periodically as your financial circumstances change.

This model is provided as a rough approximation of future financial performance that you may encounter in reaching your retirement goals. The results presented by this model are hypothetical and may not reflect the actual growth of your own investments. Polaris strives to keep its information and tools accurate and up-to-date.

The information presented is based on objective analysis, but may not be the same that you find at a particular financial institution, service provider or specific product’s site. Polaris Capital and its employees are not responsible for the consequences of any decisions or actions taken in reliance upon or as a result of the information provided by this tool. Polaris is not responsible for any human or mechanical errors or omissions. All content, calculations, estimates, and forecasts are presented without express or implied warranties, including, but not limited to, any implied warranties of merchantability and fitness for a particular purpose or otherwise.

Please confirm your agreement/understanding of this disclaimer.

DISCLAIMER: You are about to leave the Polaris Capital Management, LLC website and will be taken to the PCM Global Funds ICAV website. By accepting, you are consenting to being directed to the PCM Global Funds ICAV website for non-U.S. investors only.